In recent years, brands selling consumer packaged goods have shifted some of their sales away from brick-and-mortar stores to online channels. As a result, many consumers have begun buying directly from manufacturer websites because stores usually run out of many CPG products such as toilet paper, disinfectant, and hand sanitiser due to the pandemic. Last year, Pymnts.com and Sticky.io conducted a survey of consumers’ use of direct-to-consumer channels to purchase consumables or nonperishable items. According to the survey, 54.6 % of respondents were using such channels to make everyday purchases.

According to a survey, 67 % of millennials use brands’ websites and physical stores to purchase CPG, while 41 % of seniors do the same. Seventy-three percent of consumers who used DTC e-commerce during the pandemic indicated they would likely continue this practice, while the most common reasons were their ability to find a full range of products in stock and convenience.

While e-commerce represents less than 5% of overall consumer packaged goods (CPG) sales, direct-to-consumer (DTC) sales have driven 40% of the growth in CPG since 2020. This means that the DTC trend is nowhere near its end. The e-commerce percentage is growing at a fast pace for CPG companies in these sectors:

Pet supplies: 59.9%

Household care: 34.2%

Health/beauty: 27.7%

Grocery items: 38.4%

Baby care: 14.6%

Total FMCG: 32.5%

Despite the growing DTC craze among millennials and Gen Z, direct-to-consumer (DTC) brands can expand their marketing efforts by offering loyalty programmes and discounts, among other tactics. Moreover, brands can engage with millennial and Gen Z consumers on social media sites with their birthdates in the 1980s to late 1990s and early 2010s, respectively. According to Social Media Link Inc. research, millennials are the top consumers of DTC brands in the food, beverage, and nutrition category.

- Nescafé

Nestlé, the parent company of many popular CPG brands, wanted to differentiate itself from other home-brewed coffee options. Therefore, it chose Shopify Plus to power its Nescafé online store and started selling coffee and merchandise direct-to-consumer with a custom platform designed for them.

The company has never addressed millennials directly, but it had to change its approach: for the first time in its 153-year history, the company spoke directly to millennials and invested in social media. The main mission was to elevate coffee consumption and redefine how people experience coffee. The online campaign captured the attention of thousands of consumers and generated millions of dollars in revenue.

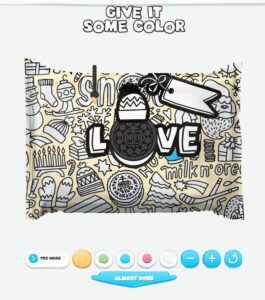

- Oreo (Mondelez International)

In celebration of their 100th birthday, Oreo launched a line of cookies that consumers could purchase directly from their website. Consumers could also visit experiential booths at festivals and events across the country to get customised packaging as well as special offers on Oreo products. The brand chose Shopify Plus to enable their DTC campaign, “Oreo Colorfilled”, allowing consumers to customise their cookie packaging and add personalised notes.

- Nike

In November 2019, Nike announced that it would no longer sell its goods wholesale to Amazon. The company had become displeased with unauthorised sellers on Amazon’s Marketplace who continued to sell Nike goods. At the time, DTC comprised 30% of Nike’s sales, a percentage the company had once expected to reach in 2023. In order to increase profitability, Nike decided that selling directly to consumers on Amazon is more profitable than through wholesale channels.

During the quarter that ended in June 2020—when lockdowns were commonplace—Nike’s direct online sales grew by 75% year-over-year to just under $2 billion. Nike was well-prepared for this surge, as it had been planning for a global sales increase of 20 percent.

- PepsiCo

PepsiCo is among the latest major corporate food and beverage companies to launch direct-to-consumer websites. In May 2020, PepsiCo debuted two sites—PantryShop.com and Snacks.com—featuring brands such as Frito-Lay, Quaker, and Gatorade. The two websites sell bundles of products based on online demand data and affinity research. PepsiCo continues to sell beverages through third-party websites such as Amazon and Walmart while also selling directly via their sites.

5. Clorox

Clorox has taken a hybrid approach to direct-to-consumer marketing by acquiring Nutranext (a manufacturer and distributor of dietary and nutritional supplements) and creating a new brand of wellness products, Objective, with its own website.

Clorox’s sales have grown fourfold since last year, as the company has shifted its focus from older consumers to millennials. Objective and Colorox’s other brands use Looker, Google’s data analytics platform, to help manage customer data and understand the purchase process.