Say goodbye to old-fashioned ice cream trucks and welcome Unilever’s Robomart

In a world full of tech-savvy consumers, Unilever never fails to disappoint its consumers’ expectations.

In a world full of tech-savvy consumers, Unilever never fails to disappoint its consumers’ expectations.

Kraft Heinz has entered into a joint venture with Pulpex to pilot and develop renewable and recyclable paper-based bottles made from 100% sustainably sourced wood pulp.

CPG giants like Colgate-Palmolive, Coca-Cola Company, and Unilever have decided to support Anheuser-Busch InBev (AB InBev) 100+ Accelerator to test and fund sustainably innovative startups in the supply chain. The 100+ Accelerator is a global incubation programme that is determined to provide solutions for supply chain challenges across sustainable agriculture, circular economy, climate action, and water stewardship. Along with funding piloting startups, the incubator programme offers mega support to startups by providing them with a team of professionals who help them test their technologies in a large supply chain network. The support of The Coca-Cola Company, Colgate-Palmolive, and Unilever will help grow this initiative and further develop the value proposition of the AB InBev 100+ Accelerator brand and aim. Read more from Consumergoods

Coca-Cola has recently announced to replace normal caps from 1.5 litre bottles of Fanta, Coca-Cola Zero Sugar, and Diet Coke with attached lids to ensure recycling of the caps as well. The beverage giant aims to roll out tethered lids across its packaging by 2024. Planet Patrol’s recent research report revealed that out of 85,000 pieces of litter collected in the UK in 2021, 5.5% belonged to the Coca-Cola company. Therefore, to fight against plastic pollution and encourage the recycling of the whole bottle including the lid, Coca-Cola is launching its attached lid bottles. Read more from Edie

The Consumer Pulse Survey conducted by McKinsey revealed seven ways in which sentiments and shopping behaviours of consumers across America are evolving. 1, Inflation is unable to stop American consumers from buying goods from the market, they have spent 12% more than they were expected to spend in March 2022. 2, Despite inflation, consumers have spent more on cosmetics, pet food, and sports apparel as compared to experiences like traveling and going to public gatherings. 3, More American consumers are switching to different brands, mainly private-label ones, to spend within budget. 4, US consumers are happily shopping online even after the pandemic and consequently, e-commerce has grown 27% year-over-year in March 2022. 5, Consumers are buying food and nonfood items from both online and physical stores as per their convenience. 6, Although consumers have resumed their outdoor activities, one-third of participating consumers are still conscious of it. 7, ESG factors influence the shopping patterns of US consumers. Read more from McKinsey

Virtual influencers are already existing in this mortal world, but metaverse, a virtual space, seems to be a perfect fit for them.

McDonald’s has entered into the virtual space of metaverse by registering 10 trademarks.

Adam Mosseri, the head of Instagram, recently announced that the application is now allowing users to share their NFTs on Instagram stories, messages, or feeds with no additional charges.

The metaverse, a modern business model, is expected to be the future of the business realm where different technologies would be used and users would be able to interact and collaborate virtually via an advanced system of networks.

E-commerce has become the new normal since the pandemic but brands need to fix the issue of returns when it comes to online shopping. 71% of consumers report that brands’ websites do not feature a sizing tool, a major reason for returns. MySize surveyed 1,000 individuals from the UK, US, Germany, Italy, and France, and collected their responses. The data revealed that 14% of Italian consumers, 10% of UK and German consumers, and 8% of French consumers often return a parcel. Besides the size issue, another reason for the return is bracketing. 33% of consumers admitted that they buy clothes and shoes in multiple sizes, intending to return the unfit ones. Online retailers and brands can minimise this return rate by introducing sizing tools to their websites. Read more from EcommerceNews

As per the data gathered by Kroger’s subsidiary, 84.51°, sustainability indicators like recyclable packaging or ingredient sourcing are not as important as food wastage. 45% of the shoppers prioritise reducing food waste, while other areas of interest include cutting single-use items and using recyclable shopping bags. Data from 84.51° informs that consumers are more sustainable-conscious in non-food categories like household cleaning 65% and personal care 61%. Within the food category, shelf-stable food and frozen food capture the attention of 61% and 56% of sustainability-conscious consumers, respectively. CPG companies can, therefore, attract consumers across the sustainability spectrum without investing much in packaging or new ingredients by reducing their food waste. Read more from FoodBusinessNews

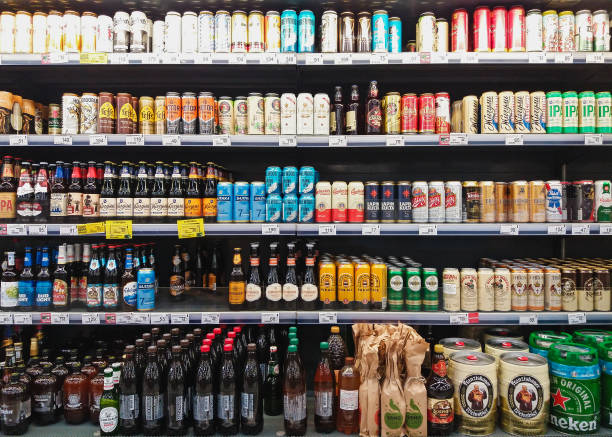

Many CPG companies are stepping up their sustainability game and rolling out products that are manufactured to emit fewer carbon emissions. The 8 carbon-neutral brands committed to reduce greenhouse gas emissions include 1, Bud Light Next, which initially introduced a zero-carb version of its beer, and now the brand is going carbon-neutral. 2, Oregon-based brand, Riff reenergised its consumers with carbon-neutral drinks. 3, Evol, Conagra’s frozen food brand, introduced carbon-neutral products in the frozen food aisle. 4, New Zealand-based Silver Fern Farms launched carbon zero Angus Beef in the US. 5, Kroger, a famous grocery giant, rolled out its carbon-neutral eggs. 6, Neutral Foods, America’s first carbon-neutral brand. 7, Mondelēz, and 8, Mrs. Read more from FoodDive

Digital tools, such as connected packaging, have allowed CPG companies to establish a curated connection with their customers. Not only does it enable companies to build brand-to-customer engagement, but also helps them collect valuable data. CPG companies like Campbell soup and Ferrara’s Keebler have deployed QR codes on their cans to give consumers access to specialised content, featuring recipes and music, while the latter connected consumers to an augmented reality experience via QR codes. The Consumer Brands Association and Alliance created a smartLabel, a QR code-empowered food label, which gives consumers access to information about sustainability indicators. Big CPG giants like Coca-Cola, Kellogg, Hershey, Colgate-Palmolive, and Procter & Gamble have featured the digital label in their packaging. Read more from SmartBrief

As per the report presented by Kearney, consumers are more aware of the climate impact of food choices. Out of every five consumers, four tend to know about the environmental impacts of food choices, but they do not buy climate-friendly foods due to high prices, the report states. While doing grocery shopping, more than 27% of individuals think of the environmental impact of the food product before putting it in their cart. While 83% of them are ready to consume a healthier alternative to beef. Many CPG companies are working to achieve their sustainability goals, including reducing carbon footprint, decreasing waste, and using better-for-the-environment ingredients. Studies further reveal that consumers are more likely to buy a product that features a sustainable practise label. Read more from FoodDive

Most of the global CPG companies are stepping up their games to reduce their carbon footprint. DHL recently published its white paper titled “Logistics of the Energy Revolution”, shedding light on some concern-worthy facts. As per the white paper, there are five areas critical for the energy transition, and companies need to keep a closer eye on them. These areas involve work end-to-end, collaboration, digitalisation, identification of transferable skills, focus on visibility, and opting for sustainable logistics solutions. The supply chain, specifically, has to undergo major transformations like digitalisation, new technologies to monitor consumption behaviours, and new logistics management processes. If CPG companies aim to achieve energy transition, they should strategically plan for the future and address logistics challenges. Read more from ArabianBusiness

Since the pandemic, consumers are more interested in better-for-you snacks, a category dominated by big giants. However, many startups and challenging brands are now disrupting the category with their innovational products. Although consumers are interested in exploring better-for-you alternatives, no one is ready to sacrifice deliciousness. Therefore, the majority of the CPG companies focus on manufacturing a product instilled with flavours like PeaTos, which recently reimaged its snack line and transformed into a vegan brand. According to SnackMagic’s consumer packaged goods data insights platform, CPGpulse, startups that are transforming the dynamics of the snacks category include Kibo Foods, Love Corn, and Air Cheese. Read more from SmartBrief

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (11th April-18th April). We have covered different categories, including: Direct-to-Consumer: Galderma, a personal skincare brand, reveals that direct feedbacks from retailers, consumers, and dermatologists decide what will be their next innovative product. AI and Robotics: Walmart, Amazon, and Reliance, along with some tech startups (backed up by big investors like Sequoia Capital, Accel, and Tiger Global), are entering into joint ventures with Indian Kirana stores to modernise the traditional store experience. Sustainability: CPG companies are focusing on water conservation to offset their carbon footprint, for example, PepsiCo and Keurig Dr Pepper announced to reduce the amount of wastewater across their operations. Consumer Trends: Kantar Worldpanel presented its study revealing 23 FMCG brands that attracted over 100 million Chinese households, including, P&G, Mengniu, Yili, Vinda, PepsiCo, Coca-Cola, Want Want, Haday, Nice and Unilever. Supply Chain: Pepsico is utilising an AI-empowered solution to improve efficiency and establish digital innovation across its supply chain operations, using 09 Solutions’ integrated business planning platform to perform real-time scenario planning.

Pepsico is utilising an AI-empowered solution to improve efficiency and establish digital innovation across its supply chain operations. PepsiCo will use 09 Solutions’ integrated business planning platform to perform real-time scenario planning. The beverage giant would be able to evaluate the supply chain and commercial situation with the help of real-time scenario planning. Plus, the firm would help PepsiCo improve its execution arm. Read more from ConsumerGoods

There are three simple keys, including ease of use, frictionless payment methods, and personalised delivery options, to attract shoppers to online channels. If consumers are given an online shopping experience that features an effective website, one-click payment method, and a variety of delivery options, then online retailers can win the loyalty of thousands of customers. Manufacturers offer DTC businesses as well, and a research study presented by Barclays manifested that 57% of consumers now buy items direct from manufacturers. As per consumers’ view, the DTC business model offers better pricing and services. Shoppers frequently buy clothes 39%, food and drink 27%, and electronics 30% from DTC businesses. Read from TheGuardian

Last year, CB Insights revealed the list of the 100 most promising private AI startups in the world. The list covered AI companies offering innovative solutions across 18 industries, including CPG and Retail, from 12 countries, including the US, UK, Canada, Japan, Denmark, Czech Republic, France, Poland, Germany, and South Korea. The top four AI-driven CPG startups that remained the top performers included 1, MSIGHTS, a marketing data transformation and reporting platform. 2, AiFi, an AI solution provider, enabling retailers to become fully autonomous. 3, Syte, a product discovery platform for e-commerce and 4, Vae.ai, a reinforcement learning platform. Read more from CBInsights

Vestiaire Collective, a Paris-based online marketplace to buy and sell authenticated pre-owned luxury fashion, has recently acquired American Tradesy. This acquisition has allowed Vestiaire Collective to grab the majority of Americans’ attention and go head-to-head against its competitor, The RealReal. Before cracking the deal, Vestiaire Collective’s US gross merchandise volume increased 75% year-over-year in the initial months of 2022 however, this deal has now made the US Vestiaire Collective’s biggest market. The co-founder and president of Vestiaire Collective, Fanny Moizant, revealed that the company is currently offering 5 million products by 10,000 brands and aims to transform the brand into the biggest global reselling marketplace. Read more from Glossy

Consumers are now more concerned about the environment and sustainability, and this trend has changed the definition of better-for-you snack. Each day, every individual loves to take a bite or two of their favourite snack items, but now consumers expect manufacturers to pack the same deliciousness in a greener and better for planet style. The business manager for branded snacks and confections in food service for Mondelez International, Malcolm McAlpine, said that this trend has extended to the packaging as well. Americans, as committed snackers, now demand sustainably delicious snacks packed in sustainable packaging. Read more from Bakingbusiness

CPG companies are focusing on water conservation to offset their carbon footprint, for example, PepsiCo and Keurig Dr Pepper announced to reduce the amount of wastewater across their operations. PepsiCo has decided to develop a technology that will be able to recover 50% of the water used to manufacture potato chips. Under PepsiCo’s Positive (pep+) initiative, the company is dedicated to expand safe water access to 8 million more people. While Keurig Dr Pepper has committed to achieve a net positive water impact by 2050. Meanwhile, to foster sustainable activities, Goldenberry, Mentos, and Sourcing are reducing plastic packaging, while Coca-Cola has committed to use reusable bottles for 25% of its beverage packing by 2030. Read more from ConsumerGoods

Nestlé is the largest CG company by revenue, and it has crafted its broader strategy by considering high growth products, digital channels, and healthier food and beverage alternatives. The brand is committed to achieve its sustainability goals, like emitting zero greenhouse gases by 2050, which are reflected in the company’s latest investment strategies. As per the data from CB Insights, Nestlé is prioritising four strategies that are reflected in its recent investments, acquisitions, and partnerships. These four strategic priorities include launching sustainable packaging, expanding its plant-based food and beverage portfolio, building relations with consumers via the DTC business module, and exploring digital health and biotech. Read more from CBInsights

Under Unilever’s SKU rationalisation process, the brand has leveraged machine learning and data-driven tool that works on the modules of advanced analytics and provides Unilever with a granular and holistic assessment of its portfolio. The tool divides the data into smaller segments, involving customer, channel, brand, and category and suggests whether to continue manufacturing products. The machine learning tool provides both total and cross-market view of rationalisation opportunities, enabling Unilever to see its top-performing products and guiding where to invest. The technology helps Unilever save additional costs and optimise both e-commerce channels and in-stores. Morgan Vawter, Unilever’s global VP, informs that the tool covers the perspectives of consumers and retailers, helping the company to make better and faster decisions. Read more from ConsumerGoods

Galderma, a personal skincare brand, reveals that direct feedbacks from consumers decide what will be their next innovative product. The senior director of current business and innovation at Galderma, Michael Sabbia, informs that the brand receives feedback from retailers, consumers, and dermatologists, which helps decide the next innovation. Another skincare brand, Gold Bond, also prioritises personalisation over the one size fits all formula. Nicole McLaughlin, the innovation director of the personal care portfolio at Gold Bond, reveals that the brand will be launching seven products in the upcoming Gold Bond age renew line, giving consumers a variety of options to choose from. Plus, Gold Bond’s website features a product finder, helping consumers find a product that is compatible with their skincare needs. Read more from DrugStoreNews

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (11th April-18th April). We have covered different categories, including: Direct-to-Consumer: Star ratings influence the shopping patterns of online buyers and companies can use this strategy to design better products, satisfy consumers and grow their sale cycle. AI and Robotics: Unilever and Ahold are entering into a joint venture with a retail marketing platform, Perch, to launch a visually interactive end caps lift that can track product engagement via AI and computer vision. Sustainability: Campbell Soup has expanded its wheat sustainability programme, now covering 108,000 acres in Maryland, Pennsylvania, Idaho, and Ohio, according to the company’s 2022 Corporate Responsibility Report. Consumer Trends: Brands like Albertsons and Target are introducing innovative lines, products, and programmes to win customers’ loyalty and are using data to run a personalised and relevant marketing campaign. Supply Chain: Shipium is providing Amazon-like supply chain tech to e-commerce retailers by establishing a tech stack, providing retailers with a supply chain coordination layer that allows them to deliver a shipment at faster and cheaper rates.

According to the research study ”FMCG Market by Type and Distribution Channel: Opportunity Analysis and Industry Forecast, 2018-2025,” the FMCG market size is expected to reach $15,361.8 billion by 2025. Many factors, including, the R&D for the new brands, the trend of online shopping, and the expansion of FMCG in the rural areas of developed companies are resulting in the growth of the FMCG industry. In the recent world scenario, consumers have maintained a hygienic lifestyle, and their shopping patterns depend significantly on hygiene compatibility. This trend has allowed FMCG companies to avail the opportunity and attract consumers by launching products compatible with their lifestyles. Unilever group, Procter & Gamble, PepsiCo, Coca-Cola company, Nestle, and Johnson & Johnson are some of the big names in the FMCG industry. Read more from EinNews

Big CPG companies and tech platforms are stepping forward and supporting the Ukrainian people. Kellogg donated $1 million to provide food for Ukrainian refugees, while Ikea’s charitable arm, The Ikea Foundation, donated $22 million to provide humanitarian assistance to the refugees. Amazon’s contributions involve donating $5 million to aid organisations like Save the Children and The Red Cross, while FedEx has given $1.5 million in humanitarian aid. Unilever in collaboration with NGOs donated $5.5 million to give food and hygiene products, while the Dove company has launched a Company-Matched Global Employee Giving Program to support Ukraine. L’Oréal has donated $1.1 million through its L’Oréal fund for women, along with 300,000 hygiene products. Read more from ADweek

Most retailers and brands struggle to acquire a fast and affordable supply chain technology like Amazon and Walmart. Shipium has decided to provide Amazon-like supply chain tech to e-commerce retailers. Shipium is establishing a tech stack, providing retailers with a supply chain coordination layer that allows them to deliver a shipment at faster and cheaper rates. The company uses the data modeling design to gather information about the cheapest and fastest shipping method and then automates it with machine learning. This way, the company claims to reduce the shipping cost by 5% and speed up the estimated delivery time. Read more from TechCrunch

In a world full of tech-savvy consumers, Unilever never fails to disappoint its consumers’ expectations.

Kraft Heinz has entered into a joint venture with Pulpex to pilot and develop renewable and recyclable paper-based bottles made from 100% sustainably sourced wood pulp.

CPG giants like Colgate-Palmolive, Coca-Cola Company, and Unilever have decided to support Anheuser-Busch InBev (AB InBev) 100+ Accelerator to test and fund sustainably innovative startups in the supply chain. The 100+ Accelerator is a global incubation programme that is determined to provide solutions for supply chain challenges across sustainable agriculture, circular economy, climate action, and water stewardship. Along with funding piloting startups, the incubator programme offers mega support to startups by providing them with a team of professionals who help them test their technologies in a large supply chain network. The support of The Coca-Cola Company, Colgate-Palmolive, and Unilever will help grow this initiative and further develop the value proposition of the AB InBev 100+ Accelerator brand and aim. Read more from Consumergoods

Coca-Cola has recently announced to replace normal caps from 1.5 litre bottles of Fanta, Coca-Cola Zero Sugar, and Diet Coke with attached lids to ensure recycling of the caps as well. The beverage giant aims to roll out tethered lids across its packaging by 2024. Planet Patrol’s recent research report revealed that out of 85,000 pieces of litter collected in the UK in 2021, 5.5% belonged to the Coca-Cola company. Therefore, to fight against plastic pollution and encourage the recycling of the whole bottle including the lid, Coca-Cola is launching its attached lid bottles. Read more from Edie

The Consumer Pulse Survey conducted by McKinsey revealed seven ways in which sentiments and shopping behaviours of consumers across America are evolving. 1, Inflation is unable to stop American consumers from buying goods from the market, they have spent 12% more than they were expected to spend in March 2022. 2, Despite inflation, consumers have spent more on cosmetics, pet food, and sports apparel as compared to experiences like traveling and going to public gatherings. 3, More American consumers are switching to different brands, mainly private-label ones, to spend within budget. 4, US consumers are happily shopping online even after the pandemic and consequently, e-commerce has grown 27% year-over-year in March 2022. 5, Consumers are buying food and nonfood items from both online and physical stores as per their convenience. 6, Although consumers have resumed their outdoor activities, one-third of participating consumers are still conscious of it. 7, ESG factors influence the shopping patterns of US consumers. Read more from McKinsey

Virtual influencers are already existing in this mortal world, but metaverse, a virtual space, seems to be a perfect fit for them.

McDonald’s has entered into the virtual space of metaverse by registering 10 trademarks.

Adam Mosseri, the head of Instagram, recently announced that the application is now allowing users to share their NFTs on Instagram stories, messages, or feeds with no additional charges.

The metaverse, a modern business model, is expected to be the future of the business realm where different technologies would be used and users would be able to interact and collaborate virtually via an advanced system of networks.

E-commerce has become the new normal since the pandemic but brands need to fix the issue of returns when it comes to online shopping. 71% of consumers report that brands’ websites do not feature a sizing tool, a major reason for returns. MySize surveyed 1,000 individuals from the UK, US, Germany, Italy, and France, and collected their responses. The data revealed that 14% of Italian consumers, 10% of UK and German consumers, and 8% of French consumers often return a parcel. Besides the size issue, another reason for the return is bracketing. 33% of consumers admitted that they buy clothes and shoes in multiple sizes, intending to return the unfit ones. Online retailers and brands can minimise this return rate by introducing sizing tools to their websites. Read more from EcommerceNews

As per the data gathered by Kroger’s subsidiary, 84.51°, sustainability indicators like recyclable packaging or ingredient sourcing are not as important as food wastage. 45% of the shoppers prioritise reducing food waste, while other areas of interest include cutting single-use items and using recyclable shopping bags. Data from 84.51° informs that consumers are more sustainable-conscious in non-food categories like household cleaning 65% and personal care 61%. Within the food category, shelf-stable food and frozen food capture the attention of 61% and 56% of sustainability-conscious consumers, respectively. CPG companies can, therefore, attract consumers across the sustainability spectrum without investing much in packaging or new ingredients by reducing their food waste. Read more from FoodBusinessNews

Many CPG companies are stepping up their sustainability game and rolling out products that are manufactured to emit fewer carbon emissions. The 8 carbon-neutral brands committed to reduce greenhouse gas emissions include 1, Bud Light Next, which initially introduced a zero-carb version of its beer, and now the brand is going carbon-neutral. 2, Oregon-based brand, Riff reenergised its consumers with carbon-neutral drinks. 3, Evol, Conagra’s frozen food brand, introduced carbon-neutral products in the frozen food aisle. 4, New Zealand-based Silver Fern Farms launched carbon zero Angus Beef in the US. 5, Kroger, a famous grocery giant, rolled out its carbon-neutral eggs. 6, Neutral Foods, America’s first carbon-neutral brand. 7, Mondelēz, and 8, Mrs. Read more from FoodDive

Digital tools, such as connected packaging, have allowed CPG companies to establish a curated connection with their customers. Not only does it enable companies to build brand-to-customer engagement, but also helps them collect valuable data. CPG companies like Campbell soup and Ferrara’s Keebler have deployed QR codes on their cans to give consumers access to specialised content, featuring recipes and music, while the latter connected consumers to an augmented reality experience via QR codes. The Consumer Brands Association and Alliance created a smartLabel, a QR code-empowered food label, which gives consumers access to information about sustainability indicators. Big CPG giants like Coca-Cola, Kellogg, Hershey, Colgate-Palmolive, and Procter & Gamble have featured the digital label in their packaging. Read more from SmartBrief

As per the report presented by Kearney, consumers are more aware of the climate impact of food choices. Out of every five consumers, four tend to know about the environmental impacts of food choices, but they do not buy climate-friendly foods due to high prices, the report states. While doing grocery shopping, more than 27% of individuals think of the environmental impact of the food product before putting it in their cart. While 83% of them are ready to consume a healthier alternative to beef. Many CPG companies are working to achieve their sustainability goals, including reducing carbon footprint, decreasing waste, and using better-for-the-environment ingredients. Studies further reveal that consumers are more likely to buy a product that features a sustainable practise label. Read more from FoodDive

Most of the global CPG companies are stepping up their games to reduce their carbon footprint. DHL recently published its white paper titled “Logistics of the Energy Revolution”, shedding light on some concern-worthy facts. As per the white paper, there are five areas critical for the energy transition, and companies need to keep a closer eye on them. These areas involve work end-to-end, collaboration, digitalisation, identification of transferable skills, focus on visibility, and opting for sustainable logistics solutions. The supply chain, specifically, has to undergo major transformations like digitalisation, new technologies to monitor consumption behaviours, and new logistics management processes. If CPG companies aim to achieve energy transition, they should strategically plan for the future and address logistics challenges. Read more from ArabianBusiness

Since the pandemic, consumers are more interested in better-for-you snacks, a category dominated by big giants. However, many startups and challenging brands are now disrupting the category with their innovational products. Although consumers are interested in exploring better-for-you alternatives, no one is ready to sacrifice deliciousness. Therefore, the majority of the CPG companies focus on manufacturing a product instilled with flavours like PeaTos, which recently reimaged its snack line and transformed into a vegan brand. According to SnackMagic’s consumer packaged goods data insights platform, CPGpulse, startups that are transforming the dynamics of the snacks category include Kibo Foods, Love Corn, and Air Cheese. Read more from SmartBrief

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (11th April-18th April). We have covered different categories, including: Direct-to-Consumer: Galderma, a personal skincare brand, reveals that direct feedbacks from retailers, consumers, and dermatologists decide what will be their next innovative product. AI and Robotics: Walmart, Amazon, and Reliance, along with some tech startups (backed up by big investors like Sequoia Capital, Accel, and Tiger Global), are entering into joint ventures with Indian Kirana stores to modernise the traditional store experience. Sustainability: CPG companies are focusing on water conservation to offset their carbon footprint, for example, PepsiCo and Keurig Dr Pepper announced to reduce the amount of wastewater across their operations. Consumer Trends: Kantar Worldpanel presented its study revealing 23 FMCG brands that attracted over 100 million Chinese households, including, P&G, Mengniu, Yili, Vinda, PepsiCo, Coca-Cola, Want Want, Haday, Nice and Unilever. Supply Chain: Pepsico is utilising an AI-empowered solution to improve efficiency and establish digital innovation across its supply chain operations, using 09 Solutions’ integrated business planning platform to perform real-time scenario planning.

Pepsico is utilising an AI-empowered solution to improve efficiency and establish digital innovation across its supply chain operations. PepsiCo will use 09 Solutions’ integrated business planning platform to perform real-time scenario planning. The beverage giant would be able to evaluate the supply chain and commercial situation with the help of real-time scenario planning. Plus, the firm would help PepsiCo improve its execution arm. Read more from ConsumerGoods

There are three simple keys, including ease of use, frictionless payment methods, and personalised delivery options, to attract shoppers to online channels. If consumers are given an online shopping experience that features an effective website, one-click payment method, and a variety of delivery options, then online retailers can win the loyalty of thousands of customers. Manufacturers offer DTC businesses as well, and a research study presented by Barclays manifested that 57% of consumers now buy items direct from manufacturers. As per consumers’ view, the DTC business model offers better pricing and services. Shoppers frequently buy clothes 39%, food and drink 27%, and electronics 30% from DTC businesses. Read from TheGuardian

Last year, CB Insights revealed the list of the 100 most promising private AI startups in the world. The list covered AI companies offering innovative solutions across 18 industries, including CPG and Retail, from 12 countries, including the US, UK, Canada, Japan, Denmark, Czech Republic, France, Poland, Germany, and South Korea. The top four AI-driven CPG startups that remained the top performers included 1, MSIGHTS, a marketing data transformation and reporting platform. 2, AiFi, an AI solution provider, enabling retailers to become fully autonomous. 3, Syte, a product discovery platform for e-commerce and 4, Vae.ai, a reinforcement learning platform. Read more from CBInsights

Vestiaire Collective, a Paris-based online marketplace to buy and sell authenticated pre-owned luxury fashion, has recently acquired American Tradesy. This acquisition has allowed Vestiaire Collective to grab the majority of Americans’ attention and go head-to-head against its competitor, The RealReal. Before cracking the deal, Vestiaire Collective’s US gross merchandise volume increased 75% year-over-year in the initial months of 2022 however, this deal has now made the US Vestiaire Collective’s biggest market. The co-founder and president of Vestiaire Collective, Fanny Moizant, revealed that the company is currently offering 5 million products by 10,000 brands and aims to transform the brand into the biggest global reselling marketplace. Read more from Glossy

Consumers are now more concerned about the environment and sustainability, and this trend has changed the definition of better-for-you snack. Each day, every individual loves to take a bite or two of their favourite snack items, but now consumers expect manufacturers to pack the same deliciousness in a greener and better for planet style. The business manager for branded snacks and confections in food service for Mondelez International, Malcolm McAlpine, said that this trend has extended to the packaging as well. Americans, as committed snackers, now demand sustainably delicious snacks packed in sustainable packaging. Read more from Bakingbusiness

CPG companies are focusing on water conservation to offset their carbon footprint, for example, PepsiCo and Keurig Dr Pepper announced to reduce the amount of wastewater across their operations. PepsiCo has decided to develop a technology that will be able to recover 50% of the water used to manufacture potato chips. Under PepsiCo’s Positive (pep+) initiative, the company is dedicated to expand safe water access to 8 million more people. While Keurig Dr Pepper has committed to achieve a net positive water impact by 2050. Meanwhile, to foster sustainable activities, Goldenberry, Mentos, and Sourcing are reducing plastic packaging, while Coca-Cola has committed to use reusable bottles for 25% of its beverage packing by 2030. Read more from ConsumerGoods

Nestlé is the largest CG company by revenue, and it has crafted its broader strategy by considering high growth products, digital channels, and healthier food and beverage alternatives. The brand is committed to achieve its sustainability goals, like emitting zero greenhouse gases by 2050, which are reflected in the company’s latest investment strategies. As per the data from CB Insights, Nestlé is prioritising four strategies that are reflected in its recent investments, acquisitions, and partnerships. These four strategic priorities include launching sustainable packaging, expanding its plant-based food and beverage portfolio, building relations with consumers via the DTC business module, and exploring digital health and biotech. Read more from CBInsights

Under Unilever’s SKU rationalisation process, the brand has leveraged machine learning and data-driven tool that works on the modules of advanced analytics and provides Unilever with a granular and holistic assessment of its portfolio. The tool divides the data into smaller segments, involving customer, channel, brand, and category and suggests whether to continue manufacturing products. The machine learning tool provides both total and cross-market view of rationalisation opportunities, enabling Unilever to see its top-performing products and guiding where to invest. The technology helps Unilever save additional costs and optimise both e-commerce channels and in-stores. Morgan Vawter, Unilever’s global VP, informs that the tool covers the perspectives of consumers and retailers, helping the company to make better and faster decisions. Read more from ConsumerGoods

Galderma, a personal skincare brand, reveals that direct feedbacks from consumers decide what will be their next innovative product. The senior director of current business and innovation at Galderma, Michael Sabbia, informs that the brand receives feedback from retailers, consumers, and dermatologists, which helps decide the next innovation. Another skincare brand, Gold Bond, also prioritises personalisation over the one size fits all formula. Nicole McLaughlin, the innovation director of the personal care portfolio at Gold Bond, reveals that the brand will be launching seven products in the upcoming Gold Bond age renew line, giving consumers a variety of options to choose from. Plus, Gold Bond’s website features a product finder, helping consumers find a product that is compatible with their skincare needs. Read more from DrugStoreNews

This is the weekly snapshot of top trends from the Consumer Goods industry in the past week (11th April-18th April). We have covered different categories, including: Direct-to-Consumer: Star ratings influence the shopping patterns of online buyers and companies can use this strategy to design better products, satisfy consumers and grow their sale cycle. AI and Robotics: Unilever and Ahold are entering into a joint venture with a retail marketing platform, Perch, to launch a visually interactive end caps lift that can track product engagement via AI and computer vision. Sustainability: Campbell Soup has expanded its wheat sustainability programme, now covering 108,000 acres in Maryland, Pennsylvania, Idaho, and Ohio, according to the company’s 2022 Corporate Responsibility Report. Consumer Trends: Brands like Albertsons and Target are introducing innovative lines, products, and programmes to win customers’ loyalty and are using data to run a personalised and relevant marketing campaign. Supply Chain: Shipium is providing Amazon-like supply chain tech to e-commerce retailers by establishing a tech stack, providing retailers with a supply chain coordination layer that allows them to deliver a shipment at faster and cheaper rates.

According to the research study ”FMCG Market by Type and Distribution Channel: Opportunity Analysis and Industry Forecast, 2018-2025,” the FMCG market size is expected to reach $15,361.8 billion by 2025. Many factors, including, the R&D for the new brands, the trend of online shopping, and the expansion of FMCG in the rural areas of developed companies are resulting in the growth of the FMCG industry. In the recent world scenario, consumers have maintained a hygienic lifestyle, and their shopping patterns depend significantly on hygiene compatibility. This trend has allowed FMCG companies to avail the opportunity and attract consumers by launching products compatible with their lifestyles. Unilever group, Procter & Gamble, PepsiCo, Coca-Cola company, Nestle, and Johnson & Johnson are some of the big names in the FMCG industry. Read more from EinNews

Big CPG companies and tech platforms are stepping forward and supporting the Ukrainian people. Kellogg donated $1 million to provide food for Ukrainian refugees, while Ikea’s charitable arm, The Ikea Foundation, donated $22 million to provide humanitarian assistance to the refugees. Amazon’s contributions involve donating $5 million to aid organisations like Save the Children and The Red Cross, while FedEx has given $1.5 million in humanitarian aid. Unilever in collaboration with NGOs donated $5.5 million to give food and hygiene products, while the Dove company has launched a Company-Matched Global Employee Giving Program to support Ukraine. L’Oréal has donated $1.1 million through its L’Oréal fund for women, along with 300,000 hygiene products. Read more from ADweek

Most retailers and brands struggle to acquire a fast and affordable supply chain technology like Amazon and Walmart. Shipium has decided to provide Amazon-like supply chain tech to e-commerce retailers. Shipium is establishing a tech stack, providing retailers with a supply chain coordination layer that allows them to deliver a shipment at faster and cheaper rates. The company uses the data modeling design to gather information about the cheapest and fastest shipping method and then automates it with machine learning. This way, the company claims to reduce the shipping cost by 5% and speed up the estimated delivery time. Read more from TechCrunch

Consumer Goods industry will surpass $15T globally by 2025. However the old business model of mass distribution is about to become obsolete. Digital Transformation, Millennials and Gen Z effect, Direct to Consumer and Post-Covid World are going to reshape the winning formula for the new era CG industry. Our weekly newsletter covers global innovations and disruptions in CG industry.

ConsumerGeniuses is managed by IndustryGeniuses (A place where industries meet innovation). We are rolling out content platforms for the world’s hottest industries such as Food & Grocery Retail, Consumer Goods and Healthcare. For each of these key industries, we support Tech Startups and Industry Disruptors as they roll out next generation digital initiatives.

IndustryGeniuses team brings practical domain knowledge of working with 300+ tech startups and brands over the past decade.